NEW GST RETURN

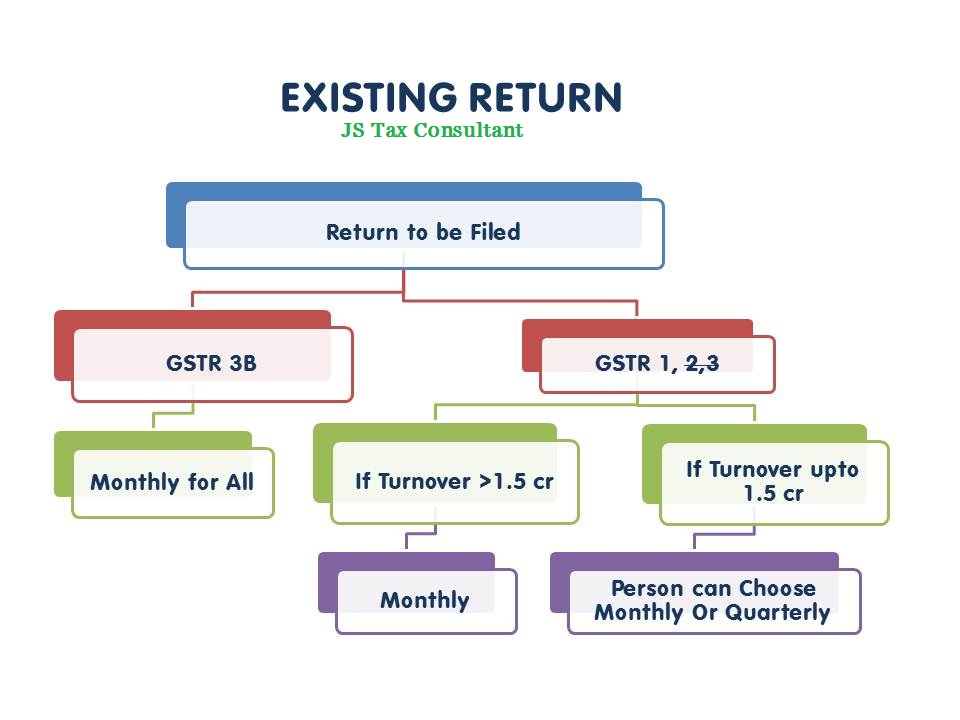

Currently GSTR 3B and GSTR 1 are filed by Taxpayers

Under this New Return System, there will be

- One Main Return GST RET-1

- 2 Annexures FORM GST ANX-1 and FORM GST ANX-2 .

Who needs GST?

GST is a tax registration mandatory for all businesses who meeting these conditions